Tap & Go

A contactless chip card allows you to tap your credit or debit card against a reader, in addition to inserting or swiping your card.

Benefits You’ll Love

- Simple to use

- Faster to use

- Provides security and fraud protection

Look at your card

This indicator on your card means you can tap to pay anywhere you see the Contactless Symbol.

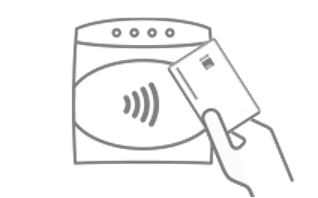

Look at the terminal

Look for the Contactless Symbol at contactless-enabled merchant terminals, transit turnstiles, and for debit card use at FOCUS Bank ATMs.

Tap your card

Tap or hold your contactless card near the Contactless Symbol on the checkout terminal.

You may be asked to enter your Personal Identification Number (PIN) or sign for debit card transactions. If a contactless terminal isn’t available, just insert or swipe your card.

Protection

Whether you tap, insert, or use the magnetic stripe for your transactions, your card comes with 24/7 fraud monitoring and card controls.

Simple to use

Just tap your card where you see the Contactless Symbol—it's even easier than swiping or inserting your card.

At a FOCUS Bank ATM, tap your contactless debit card and then enter your PIN to get cash, view account balance, and more.

Flexible everyday

Tap your card to help speed up your checkout at fast food restaurants, pharmacies, grocery stores, and more. Plus, use your contactless card at participating transit systems nationwide.

Ready to go contactless? Apply for a FOCUS Bank checking account today. Already a FOCUS Bank cardholder? Contact us to request a contactless card.

Tips

If you receive a replacement card, it will have a new expiration date and security code. Remember to notify any merchants if you have provided your card information for scheduled payments or ongoing purchases.

Remember you can also add your card to your preferred digital wallet1. Then just tap your mobile device where you see the Contactless Symbol.

Getting a debit card with the added contactless feature is easy:

- Existing customers will receive a contactless chip card when they request a replacement card or their card is reissued.

- You can request a contactless debit card by visiting your local FOCUS Bank branch.

- To activate your new card, call 1-880-992-3808.

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Example Rate

| Balance | Minimum Opening Deposit | Rate | APY |

|---|---|---|---|

| 0 - $15,000 | $x | 0.00% | 0.00% |

| $15,000+ | $x | 0.00% | 0.00% |

| All balances if qualifications not met | $x | 0.00% | 0.00% |

Qualifications

xx

Online Only Specials

| Term | Minimum Opening Deposit | Rate | *APY |

|---|---|---|---|

| 7 Month Online CD Special | $1000 | 3.75% | 3.80%* |

| 11 Month Online CD Special | $1000 | 3.70% | 3.75%* |

| Call for In-Branch CD Rates |

7 month online only CD -

*Annual percentage yield. Annual Percentage Rate 3.75%. $1000 minimum deposit to open. Interest is compounded quarterly. Effective date 1/22/26. Auto-renew provision with certificate renewing for 6 months at the going rate. Penalty for early withdrawal. Certain conditions and restrictions may apply. See website for details. MEMBER FDIC

11 month online only CD -

*Annual percentage yield. Annual Percentage Rate 3.70%. $1000 minimum deposit to open. Interest is compounded quarterly. Effective date 1/22/26. Auto-renew provision with certificate renewing for 12 months at the going rate. Penalty for early withdrawal. Certain conditions and restrictions may apply. See website for details. MEMBER FDIC

Please call 800-464-3150 or your local branch for in-branch specific rates.